THE NEW ePAY!

There are countless reasons to sign up for ePAY. ePAY helps you take more constituent payments electronically through our custom, safe payment solution. If you’re interested, contact us for more information.

- Contemporary Solutions - Allow your constituents to pay using mobile wallets over-the-counter or use recurring bill pay when paying online. Additionally, start collecting your constituents’ contact information to allow you to send email communications and e-Bills. You also have the ability to turn on e-Receipts for over-the-counter transactions.

- Secure Investment and Settlement Options - Earn a greater return on your balances by having your funds automatically deposited to an Illinois Funds investment account, or elect to settle to an outside bank.

- Competitive Pricing - Whether you pass the processing fee to your constituents or absorb the fee, take advantage of affordable pricing options. This includes but is not limited to the bundling of equipment costs with processing fees resulting in lower fees by funding to The Illinois Funds.

- Enhanced Security - The ePAY processor is a PCI DSS Level 1 Service Provider and NACHA compliant. Our payment solutions now offer greater security to help minimize your PCI scope. ePAY also offers PCI validation, tracking, and reporting tools at no additional cost.

- First in Class Customer Support - A dedicated help desk via our toll-free number available 24/7 and the online ticketing portal will allow us to resolve participant tickets as quickly as possible.

ePAY PAYMENT SOLUTIONS

Point-of-Sale (POS)

Simple and convenient over-the-counter payment solutions. Our recommended integration option is Hosted, Semi-Integrated because it offers real-time reporting capabilities, as well as the ability to utilize text or e-receipts.

Comparison of Integration Options: PAX POS Devices

|

Hardware Model

|

PAX A80 / A920* / Pax A35 (No Printer)

|

PAX A80 / A920* / A77**

|

PAX A80 / A920* / A77**

|

|

Process EMV Payments

|

✔ / ✔ / ✔

|

✔ / ✔ / ✔

|

✔ / ✔ / ✔

|

|

End-to-end encryption to limit PCI Scope

|

✔ / ✔ / ✔

|

✔ / ✔ / ✔

|

✔ / ✔ / ✔

|

|

Real time reporting capabilities through the ePAY Dashboard

|

✔ / ✔ / ✔

|

✔ / ✔ / ✔

|

X / X / X

|

|

Cashier reports from terminal

|

✔ / ✔ / ✔

|

X / X / X

|

✔ / ✔ / X

|

|

*Wireless & ethernet capable with purchase of separate base

|

**Wi-Fi capable only

(No Printer)

|

|

|

ePAY PAYMENT SOLUTIONS

Point-of-Sale (POS)

Simple and convenient over-the-counter payment solutions. Our recommended integration option is hosted, semi-integrated because it offers real-time reporting capabilities, as well as the ability to utilize text or e-receipts.

Comparison of Integration Options: Verifone POS Devices

|

Hardware Model

|

Verifone V200c / Verifone V400c

|

Verifone V200c / Verifone V400c

|

Verifone V200c / Verifone V400c

|

|

Process EMV Payments

|

✔ / ✔

|

✔ / ✔

|

✔ / ✔

|

|

End-to-end encryption to limit PCI Scope

|

✔ / ✔

|

✔ / ✔

|

✔ / ✔

|

|

Real time reporting capabilities through the ePAY Dashboard

|

✔ / ✔

|

✔ / ✔

|

X / X

|

|

SMS text/e-receipt

|

✔ / ✔

|

✔ / ✔

|

✔ / ✔

|

|

Cashier reports from terminal

|

✔ / ✔

|

✔ / ✔

|

✔ / ✔

|

|

Verifone V400m*** Wireless POS Device

|

***Estimated availability Q1 2024

|

|

|

Note: Hosted Semi-Integrated payment modes of collection support Customer account validation of account information. Account validation options may vary based on availability of data and Participant configurations.

(POS) Equipment Options

ePAY supports and recommends EMV point-of-sale (POS) transactions using the PAX and Verifone suite of POS devices offered. These specific devices were chosen to offer IP, Wi-Fi, and Dial-Up connectivity. The PAX A80 offers (IP or Wi-Fi connectivity) and the Verifone V200c offers (IP, Wi-Fi connectivity and Dial-Up.) These EMV capable point-of-sale devices also offer near-field communication (NFC) capabilities to allow for mobile wallet payments such as ApplePay, GooglePay, and SamsungPay. The EMV readers also utilize point-to-point encryption (P2PE) to minimize PCI scope and protect card data. For a POS option where internet access and/or power is not available, the ePAY processor supports the PAX A920 and Verifone V400m for Wireless/Wi-Fi point-of-sale EMV payments, which utilizes the AT&T cellular data network. ePAY offers an Equipment Replacement Program on all equipment offered. Should your POS device(s) become defective at any time, while participating in the ePAY Program and processing transactions, your device will be replaced at no additional cost to you.*^*

*^* Equipment Replacement Program excludes the CX5, CX7 and Aloha Silver POS Point-of-Sale solutions. These devices carry a separate warranty program.

To review the benefits of the Pax A77 click here.

To review the benefits of the Pax A80 click here.

To review the benefits of the Pax A920 click here.

To review the benefits of the Pax IM20 click here.

To review the benefits of the Pax A35 click here.

To review the benefits of the NCR-CX5 click here.

To review the benefits of the NCR-CX7 click here.

To review the benefits of the Pax Q25 click here.

To review the benefits of the Verifone P200 click here.

To review the benefits of the Verifone V200c click here.

To review the benefits of the Verifone V400c click here.

POS Kiosk

The CX7 Kiosk Solution is a dedicated, customer-facing all in one device that can manage payment transactions. The device is a purpose-built Kiosk environment that is browser-based and secure. For pricing or to learn more about the Kiosk solution, please reach out to your ePAY representative or visit this link.

Mobile

Through our over-the-counter payment solutions, accept ApplePay, SamsungPay, and GooglePay. Also, your payments webpage is optimized for mobile use so constituents can make payments from any mobile device, so no need to develop a custom application to take mobile payments.

Online

Constituents can make their payment online through your customized payments webpage. Your payments webpage is optimized for mobile use so constituents can make payments from any mobile device. Our recommended integration method is fully hosted. With a fully hosted webpage you can simply send us your billing data and we recreate bills for presentment on your website. If paired with customer data, it is possible to also e-mail these bills.

Comparison of Integration Options:

|

Accept cards & e-checks

|

✔

|

✔

|

|

Real time reporting capabilities through the ePAY Dashboard

|

✔

|

✔

|

|

SMS text/e-receipt

|

✔

|

X

|

|

Void/credit from ePAY Dashboard

|

✔

|

✔

|

|

Validation of Customer account info

|

✔

|

✔

|

|

Outbound Communications

|

✔

|

✔

|

|

No Participant programming required

|

✔

|

X

|

|

e-Bill presentment

|

✔

|

X

|

Note: Fully Hosted payment modes of collection support Customer account validation of account information. Account validation options may vary based on availability of data and Participant configurations.

Telephone

A hosted IVR (Interactive Voice Response) solution is available to accept convenient, self-service, telephone payments from your constituents 24 hours a day.

Comparison of Integration Options:

|

Accept cards & e-checks

|

✔

|

✔

|

|

Real time reporting capabilities through the ePAY Dashboard

|

✔

|

✔

|

|

SMS text/e-receipt

|

✔

|

X

|

|

Validation of Customer info

|

✔

|

X

|

|

Posting of Transaction back to info system

|

✔

|

X

|

|

Voice/credit from ePAY Dashboard

|

✔

|

X

|

|

Outbound Communications

|

✔

|

X

|

|

No Participant programming required

|

✔

|

X

|

Note: Fully Hosted payment modes of collection support Customer account validation of account information. Account validation options may vary based on availability of data and Participant configurations.

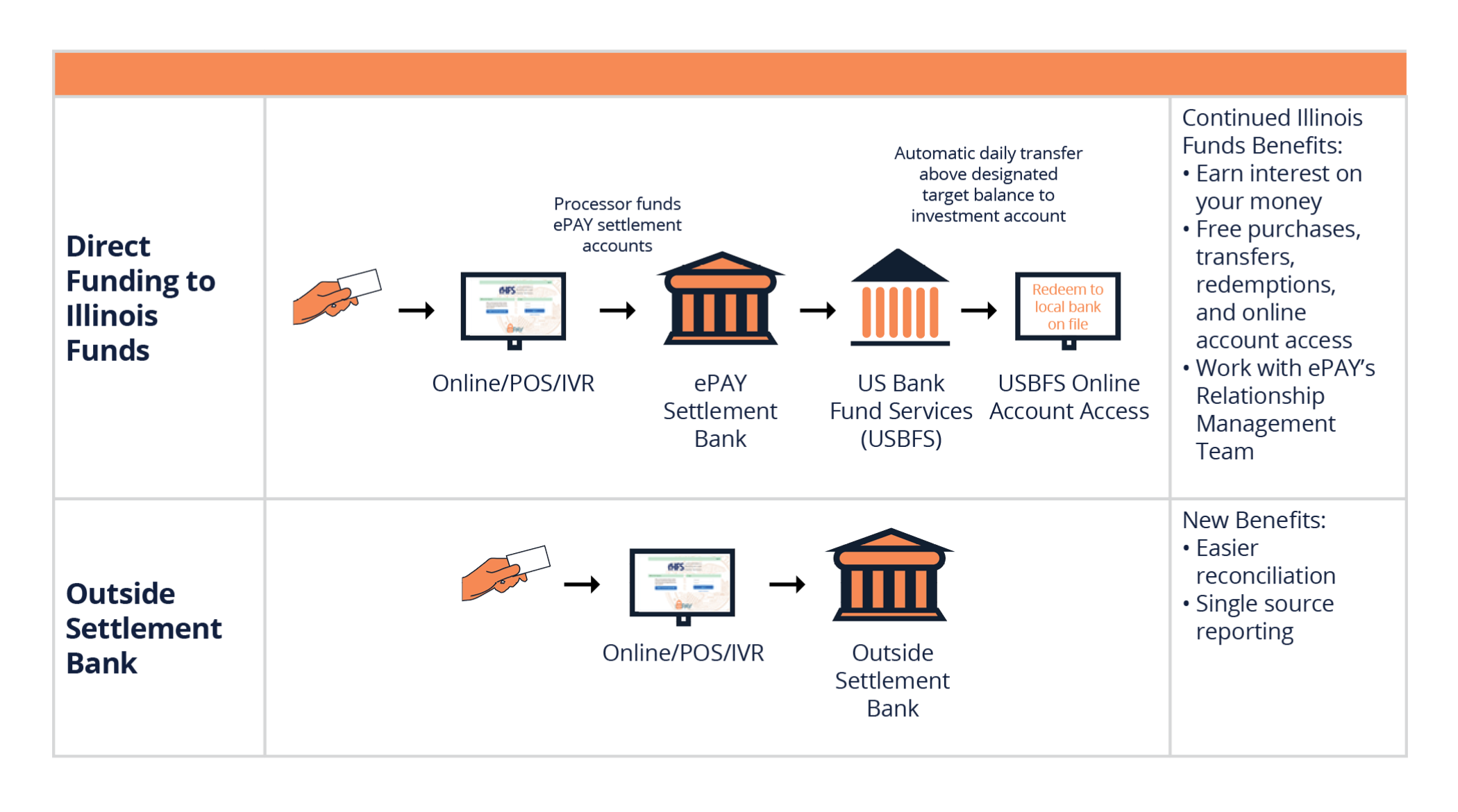

SETTLEMENT BANK OPTIONS

With ePAY, government agencies have the opportunity to earn greater returns as part of The Illinois Funds, a AAAm rated fund recognized for its safety, liquidity, and return capabilities. ePAY funds are deposited directly into your Illinois Funds investment account(s)1, or you can elect to fund to a settlement account at a bank of your choosing.2

How it works:

1Illinois National Bank (INB) is the custodian for ePAY settlement account(s). INB automatically transfers any funds over your target balance to your Illinois Funds investment account(s) at US Bank at 8:30 a.m. daily.

2Unless a state agency has the option to fund to a locally held account.

Benefits with The Illinois Funds:

|

Monthly Maintenance Fee

|

$0*

|

Varies by Bank

|

|

Credit Fee

|

$0.10 per credit

|

Varies by Bank

|

|

Settlement Account Earnings Credit Rate

|

0.17% APY

|

Varies by Bank

|

|

Online Banking

|

1 user free ($5 per additional user)

|

Varies by Bank

|

|

Minimum Target Balance

|

$1,000-$250,000

|

Varies by Bank

|

|

Fee for Insufficient Funds

|

$30

|

Varies by Bank

|

|

Interest Earnings

|

Yes

|

None

|

|

Fees for Transfers

|

$0**

|

None

|

|

Funding/Settlement Customer Service Support

|

Assistance from ePAY Relationship Management Team

|

None

|

1Illinois National Bank (INB) is the custodian for ePAY settlement account(s) that fund to The Illinois Funds. INB automatically transfers any funds over your target balance to your Illinois Funds investment account(s) at US Bank at 8:30 a.m. daily. 2State agencies do not have this option available per the Deposit of Statement Monies Act (15ILCS520), unless a state agency has the option to fund to a locally held account.

*ePAY processor will credit the Participant $10 every month to offset Settlement Bank account maintenance fees. **No fee for daily transfers from Illinois National Bank to Illinois Funds investment accounts at US Bank Fund Services. No fee for ACH or wire transfers from Illinois Funds investment accounts to banks on file.

MULTIPLE PRICING OPTIONS

In addition to settlement bank options, ePAY offers affordable pricing options with a full warranty on all equipment at no additional cost.

Passing

Passing allows you to pass on the processing fees to your constituent. In addition, all passing pricing includes the cost of POS equipment. The only decision you are asked to make is whether you will fund to your Illinois Funds investment account or go outside and use your own settlement bank.

Credit Card Processing Fees

|

Use ePAY's Settlement Bank*

|

2.25% minimum of $1.00

|

|

Use Participant's own Settlement Bank**

|

2.30% minimum of $1.00

|

*Contractor will credit the Participant $10 every month to offset monthly Settlement Bank account maintenance fees. **Processing Fee includes the cost of any Supported Device, selected by the participant, which shall be provided based upon Participant volume: $1 = 1 Supported Device per $300,000 in processing volume. Notwithstanding the foregoing, the Contractor reserve the right to offer Participants free supported Devices, regardless of processing volume.

e-Check Processing Fees

|

e-Check with gVerify* - Basic

|

$0.50 per transaction

|

|

e-Check with gVerify*

|

$0.85 per transaction

|

*gVerify is a third-party account verification service. Using an ACH routing number and an account number, gVerify references multiple data sources to determine if the account is open, active, currently reflecting a positive balance, and the accountholder name matched the payor name on file. gVerify Basic performs ACH account validation referencing fewer data sources to determine the account is currently open and able to receive debit transactions. Each account lookup constitutes a gVerify or gVerify- Basic, (as applicable) transaction.

Absorbing

Under absorb pricing you have the option to automatically deposit your funds into your Illinois Funds investment account or to your own settlement bank for higher pricing. Also, you have the option to include the cost of your POS equipment within your processing fees or pay for your equipment upfront. You will also benefit from a low American Express rate of 2.15% plus 3 basis points and $.03/transaction fee.

Please note under this scenario the ePAY processor will auto debit your settlement account on the fifth day of the subsequent month or the next business day if the fifth day is a weekend or a holiday. However, state agencies will be invoiced by the fifth day of the subsequent month with payment due at fifty (50) days of receipt of an invoice.

Credit Card Processing Fees

|

Use ePAY's Settlement Bank*

|

Cost^ plus 3 basis points and $0.03 per transaction

|

Cost^ plus 8 basis points and $0.03 per transaction

|

|

Use Participant's own Settlement Bank**

|

Cost^ plus 3 basis points and $0.03 per transaction. $15/mos.

|

Cost^ plus 8 basis points and $0.03 per transaction. $15/mos.

|

*Contractor will credit the Participant $10 every month to offset monthly Settlement Bank account maintenance fees. **Contractor will assess the Participant $15 every month regardless of the number of accounts held by such Participant. ^Interchange rates, dues, assessments, and other pass through fees from the Card Brands or third party gateways.

e-Check Processing Fees

|

e-Check with gVerify* - Basic

|

$0.08 per transaction

|

|

e-Check with gVerify*

|

$0.43 per transaction

|

*gVerify is a third-party account verification service. Using an ACH routing number and an account number, gVerify references multiple data sources to determine if the account is open, active, currently reflecting a positive balance, and the accountholder name matched the payor name on file. gVerify Basic performs ACH account validation referencing fewer data sources to determine the account is currently open and able to receive debit transactions. Each account lookup constitutes a gVerify or gVerify- Basic, (as applicable) transaction.

Fees That Apply to Both Passing and Absorbing

In addition to Settlement Bank options, ePAY offers affordable pricing options with a full warranty on all equipment at no additional cost.

Supported Devices Fees - P2PE and EMV Devices:

• Long-term rentals (life of Participant agreement).

• Each device comes with a lifetime warranty.

|

PAX A35 (No Printer)

|

$400

|

$15

|

$75

|

N/A

|

|

PAX A920

(Includes 1 SIM Card)

|

$500

|

$25

|

$75

|

$25

|

|

PAX A920

Dock Charge Only

|

$100

|

N/A

|

N/A

|

N/A

|

|

PAX A920 Docking Station

|

$175

|

N/A

|

N/A

|

N/A

|

|

PAX A80

|

$300

|

$15

|

$75

|

N/A

|

|

PAX Q25 Pin Pad

|

$400

|

$15

|

$75

|

N/A

|

|

PAX A80 with PAX Q25

|

$600

|

N/A

|

N/A

|

N/A

|

|

PAX A77

|

$575

|

$15

|

$75

|

N/A

|

|

Verifone V200c Plus

|

$500

|

$15

|

$75

|

N/A

|

|

Verifone P200 Plus Pin Pad

|

$400

|

$15

|

$75

|

N/A

|

|

Verifone V200c Plus w/Verifone P200 Plus

|

$800

|

N/A

|

N/A

|

N/A

|

|

Verifone V400c Plus

|

$500

|

$15

|

$75

|

N/A

|

|

Verifone V400c Plus w/Verifone P200 Plus

|

$800

|

N/A

|

N/A

|

N/A

|

|

Verifone V400m

|

$600

|

$25

|

$75

|

$25

|

|

PAX IM20

|

$800

|

$15

|

$75

|

N/A

|

|

CX5 PBP Countertop Kiosk

|

Contact ePAY for pricing and information

|

N/A

|

N/A

|

N/A

|

|

CX7 PBP Countertop Kiosk

|

Contact ePAY for pricing and information

|

N/A

|

N/A

|

N/A

|

|

Account Maintenance

|

w/Direct Debit $10 per month

|

w/Invoice $12 per month

|

|

OnlineBanking

|

First User Included

|

Additional Users $5.00 each

|

|

Credits to the Account:

|

$0.10 per item

|

|

Earnings Credit Rate:

|

0.17% APY

|

|

Insufficient Funds (NSF) Fee:

|

$30/item

|

A target balance of at least $1000 should be maintained to cover potential chargebacks and account debits to prevent NSF items.

PARTICIPANT RESOURCES

Enrollment Checklist

To help make your enrollment as seamless as possible we have created a enrollment checklist and workflow for you to follow and share with your stakeholders.

Frequently Asked Questions (FAQs)

Please take a moment to review our answers to frequently asked questions.

Glossary of Electronic Payments Industry Terms

To help you navigate through our website and product information we have prepared a glossary of common industry terms for your reference.

Glossary of ePAY Terms

To help you complete our enrollment materials please review our glossary of ePAY terms.

Training

For current ePAY participants, please review our training videos for more information about ePAY services and reporting.